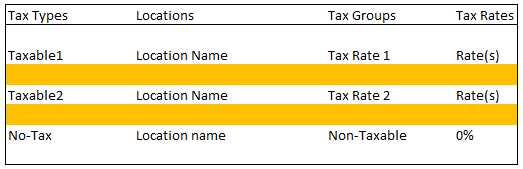

Setup Of A Single Location With Different Tax Rates And Tax Types

This guide is a basic setup for a store that will only have one location and Multiple Tax Rates.

Note: This is a guide and not intended to be the way taxes “Have” to be set up.

The following is a basic suggested model and instructions on how to set up.

Note: The names used for the Tax Types, Locations, Tax Groups, and the amounts set in the Tax Rates, are all for demonstration purposes only. Feel free to use whatever names and rates applicable for your location.

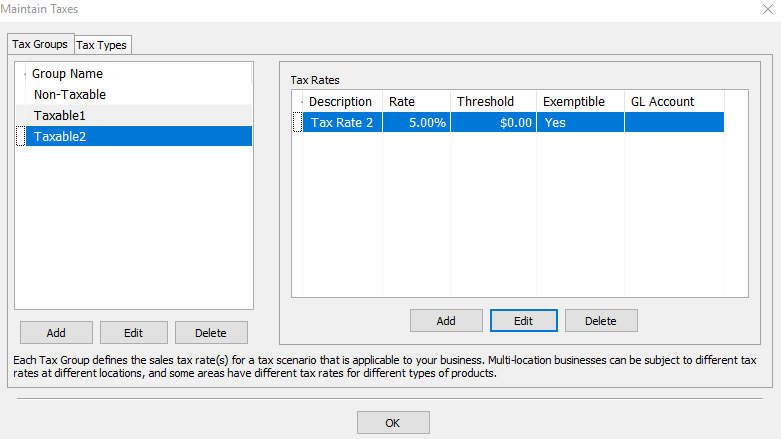

Create Tax Groups

1.Create three Tax Groups. One for Taxable1, another for Taxable2 and one for Non-Taxable sales.

Note: Check Out Setting Up Tax Codes, Tax Groups, and Tax Rates and Tax Types and Location/Tax Group Association for details on setting up tax codes.

2.For Taxable1 enter in the Tax Rate.

3.For Taxable2 enter in the Tax Rate.

4.For Non-Taxable enter in a rate of 0% in the Tax Rate.

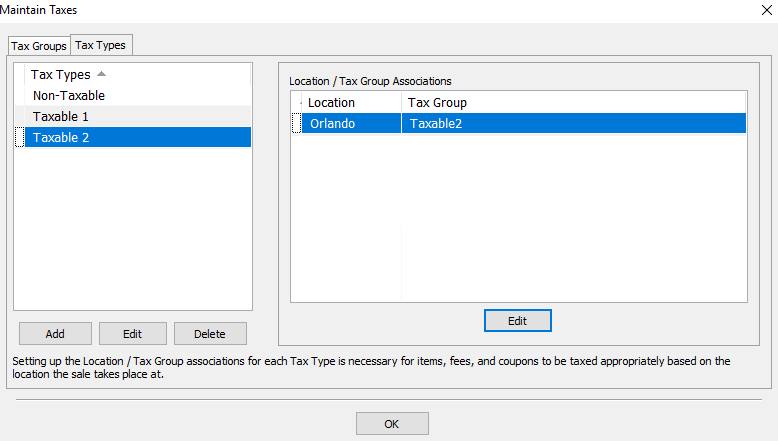

Create Tax Types And Apply The Location/Tax Group Associations

1. Click on the Tax Type tab then click on Add and add three new tax types. One for Taxable 1, Taxable 2, and Non-Taxable.

2.For Taxable 1 Tax Type, set the Location to have the group association of the Taxable1 group.

3.For Taxable 2 Tax Type, set the Location to have the group association of the Taxable2 group.

4.For the Non-Taxable Tax Type, set it to have the group association of Non-Taxable group.

Related Topics

Setting Up Tax Codes, Tax Groups, and Tax Rates

Set Up Product Lines

The Category Editor

Tax Types and Location/Tax Group Association

Setup Of A Single Location With Single Rate On All Items

Setup Of Multiple Locations And Single Rate For Each Location

Setup of Multiple Locations With Different Rates Based on Items and Locations

Setup of Multiple Locations With Same Tax Rate For Items, Different Rates Based On Location